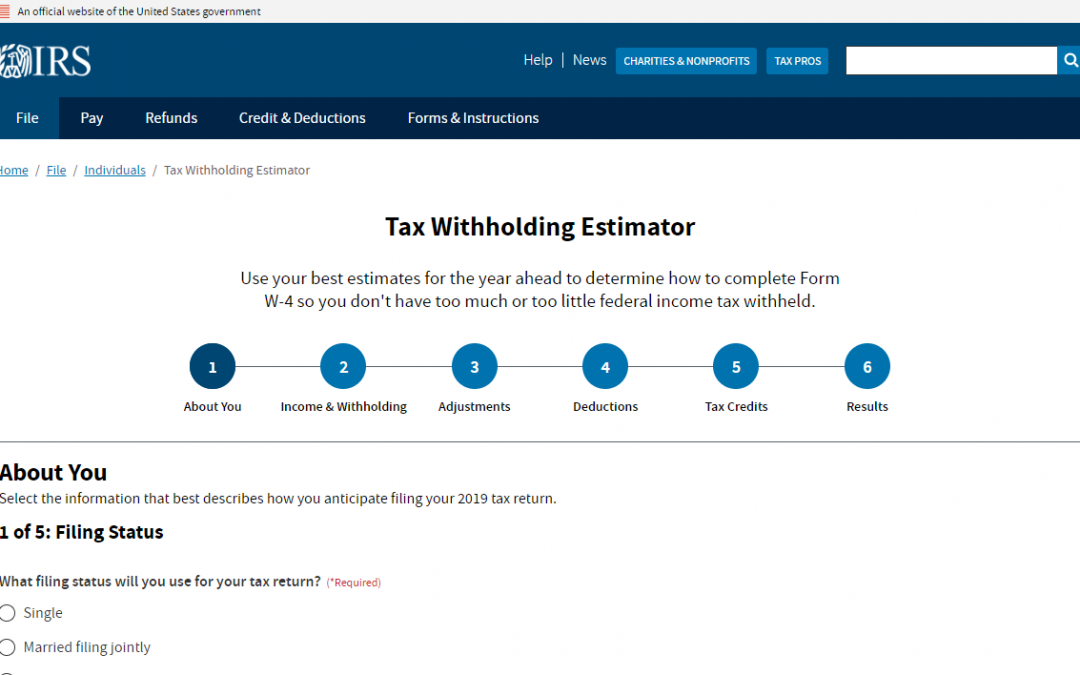

IRS launches new Tax Withholding Estimator; Redesigned online tool makes it easier to do a paycheck checkup.

The new Tax Withholding Estimator will help anyone doing tax planning for the last few months of 2019. Like last year, the IRS urges everyone to do a Paycheck Checkup and review their withholding for 2019. This is especially important for anyone who faced an unexpected tax bill or a penalty when they filed this year. It’s also an important step for those who made withholding adjustments in 2018 or had a major life change.

Those most at risk of having too little tax withheld include those who itemized in the past but now take the increased standard deduction, as well as two-wage-earner households, employees with non-wage sources of income and those with complex tax situations.

To get started, check out the Tax Withholding Estimator on IRS.gov.